Selling Your Home? You May Need an ATO Clearance Certificate

The laws governing Australia’s property market are always changing, so it can be difficult to keep on top of which new rules apply to you.

But if you’re selling your property for $750,000 or more, you need to know about ATO clearance certificates.

What the new laws say

The Australian government recently changed the rules for capital gains withholding taxes.

These changes affect Australian residents selling property with a contract price of $750,000 or more.

Beginning on 1 July 2017, if you’re an Australian resident selling “real property” over this threshold, you must obtain a clearance certificate from the ATO before your property settlement to avoid withholding tax.

If you don’t have a clearance certificate before your settlement date, the buyer will be legally required to withhold 12.5% of the purchase price and pay it to the ATO rather than to you.

12.5% is a pretty hefty chunk of money ($125,000 for a million-dollar home), so you should organise your clearance certificate sooner rather than later. In fact, the ATO specifically encourages sellers to complete and lodge a clearance certificate application form “as early as practical”.

Applying for a clearance certificate

The ATO loves to do things online, and that includes clearance certificate applications.

To apply for a clearance certificate, all you (or your solicitor, accountant or tax agent) need to do is visit the ATO website. You’ll find the application form here.

The rules for clearance certificate applications are explained on the ATO website here. The page also explains how to fill out the application form.

Key things to pay attention to include:

- who can fill out the form

- when you must provide your clearance certificate to the person or entity buying your property

- rules for applications if the property you’re selling is also in your spouse or partner’s name

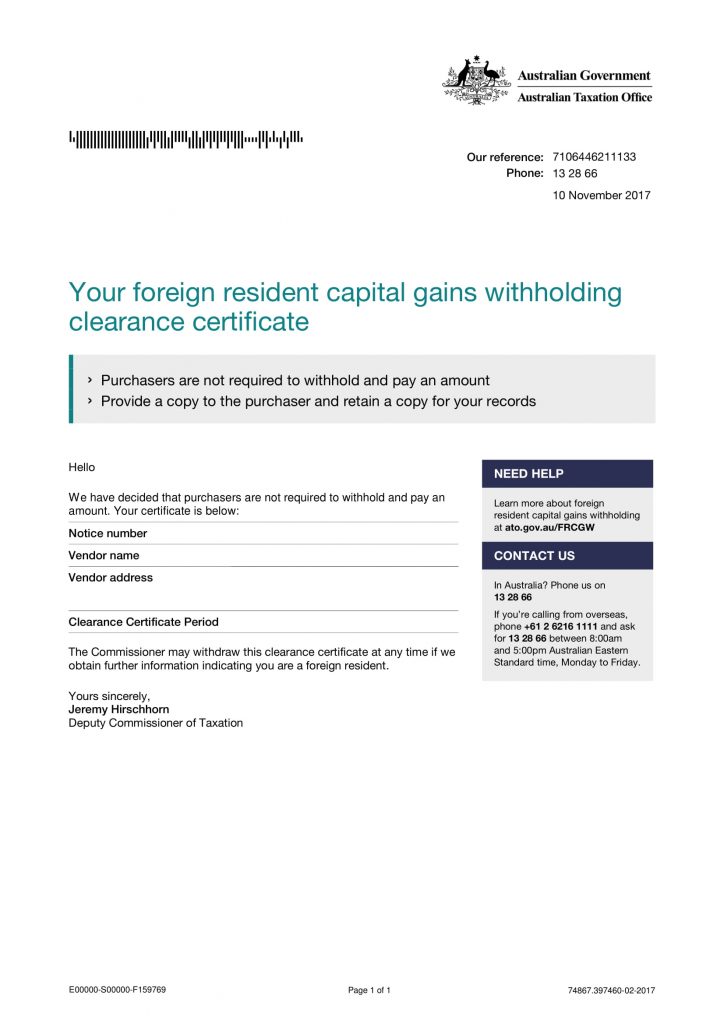

Sample of ATO Clearance Certificate:

Professional advice

The information in this blog is based on information that’s freely available from the ATO website. However, it doesn’t constitute legal advice, so if that’s what you want or need, we recommend you speak to your solicitor.

Otherwise, if you have any questions about selling your property – including questions about clearance certificates – we’d love to hear from you. Simply give Henry a call today on 0412 471 588.